Which of the following statements concerning internal controls is true – Internal controls play a pivotal role in ensuring the accuracy and reliability of financial reporting, safeguarding assets, and preventing fraud. Understanding their significance, it is imperative to delve into the intricacies of internal controls, exploring their components, objectives, types, and limitations to establish a robust and effective internal control system.

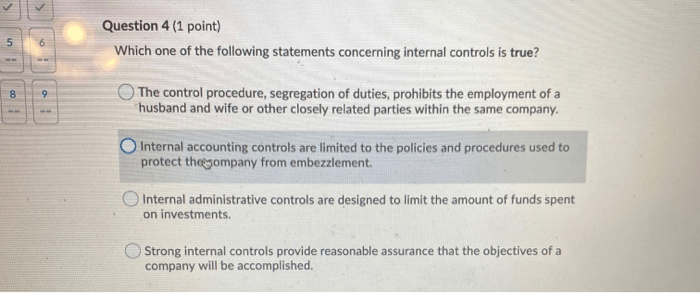

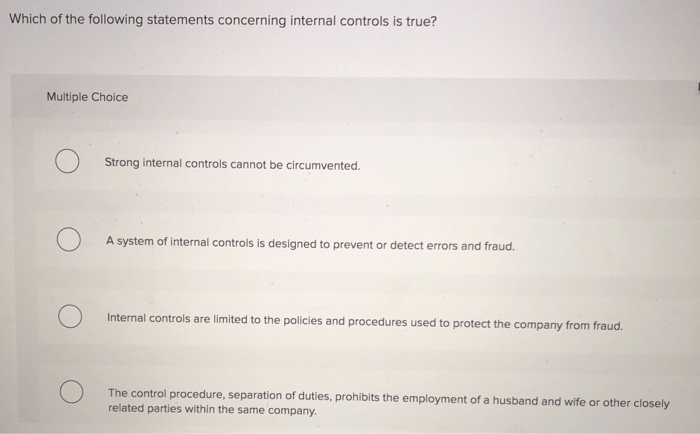

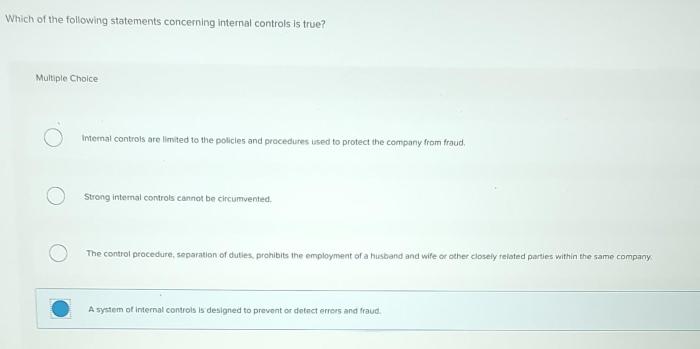

Internal controls are a comprehensive set of policies, procedures, and measures designed to provide reasonable assurance that an organization’s objectives are met. They encompass a wide range of activities, from establishing clear roles and responsibilities to implementing physical safeguards and conducting regular audits.

Internal Control Fundamentals: Which Of The Following Statements Concerning Internal Controls Is True

Internal controls are a system of policies, procedures, and activities designed to provide reasonable assurance that an organization’s objectives are achieved, risks are managed, and financial reporting is accurate and reliable.

Examples of internal controls include:

- Segregation of duties

- Authorization of transactions

- Reconciliation of accounts

Internal controls are essential for organizations because they help to prevent fraud, errors, and other financial irregularities.

Components of Internal Controls (COSO Framework)

The COSO framework identifies five components of internal controls:

- Control environment

- Risk assessment

- Control activities

- Information and communication

- Monitoring

| Component | Description |

|---|---|

| Control environment | The tone and culture of an organization, as well as its management’s philosophy and operating style. |

| Risk assessment | The process of identifying, assessing, and responding to risks that may affect the achievement of an organization’s objectives. |

| Control activities | The policies and procedures that are implemented to prevent or detect fraud and errors. |

| Information and communication | The system used to collect, record, and communicate financial and other information. |

| Monitoring | The process of assessing the effectiveness of internal controls and making necessary adjustments. |

Objectives of Internal Controls

The primary objectives of internal controls are to:

- Prevent fraud and errors

- Ensure the accuracy and reliability of financial reporting

- Promote operational efficiency

- Safeguard assets

- Comply with laws and regulations

Internal controls help organizations achieve these objectives by providing a framework for identifying and mitigating risks.

For example, segregation of duties helps to prevent fraud by ensuring that no one person has complete control over a transaction.

Commonly Asked Questions

What are the five components of internal controls?

The five components of internal controls, according to the COSO framework, are control environment, risk assessment, control activities, information and communication, and monitoring.

What is the primary objective of internal controls?

The primary objective of internal controls is to provide reasonable assurance that an organization’s objectives are met, including the accuracy and reliability of financial reporting, safeguarding of assets, and prevention of fraud.

Can internal controls completely eliminate risk?

No, internal controls cannot completely eliminate risk. However, they can reduce the likelihood and impact of risks by providing reasonable assurance that risks are identified, assessed, and mitigated.